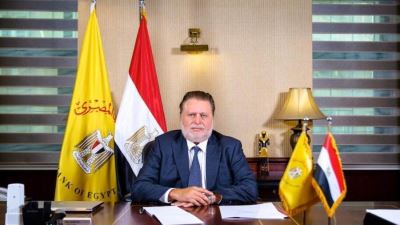

An Exclusive Interview with Hassan Abdalla, Governor of the Central Bank of Egypt

Central Bank of Egypt: Steering Stability, Innovation, and Investor Confidence

Over the past two years, Egypt’s economy has navigated a period of profound global and domestic challenges. In an exclusive discussion with Global Finance, Hassan Abdalla, Governor of the Central Bank of Egypt (CBE), outlines how the Bank has responded to external shocks, stabilized the macroeconomic environment, and positioned the financial system for sustainable growth and innovation.

Navigating Global and Domestic Challenges

Governor Abdalla emphasized that the past two years presented extraordinary global headwinds. Internationally, Egypt faced a sharp surge in commodity prices, alongside aggressive monetary tightening by major central banks—raising interest rates by over 500 basis points—which triggered capital outflows from emerging markets. Heightened geopolitical tensions further exacerbated the situation, with disruptions in the Red Sea reducing Suez Canal revenues and straining foreign currency inflows.

Domestically, inflation soared to multi-decade highs, peaking above 35% in 2023, largely driven by currency depreciation and imported inflation. The Egyptian pound came under severe pressure, with successive devaluations between 2022 and 2024 generating volatility and import bottlenecks that affected industrial operations.

In response, the CBE adopted decisive monetary measures, raising policy rates by a cumulative 1,900 basis points from 2022 to 2024 to contain inflation. The landmark exchange rate unification in March 2024 marked a turning point—restoring transparency, eliminating distortions, and channeling foreign currency back into the official market.

Exchange Rate Reform and Monetary Policy Transition

According to Abdalla, the March 2024 currency float was “a bold but necessary step” that restored balance and credibility to Egypt’s foreign exchange market. The flexible exchange rate has acted as a “shock absorber,” enabling real-time adjustment to global pressures.

By mid-2024, the results began to materialize. Inflation declined to 25.7% and then to 12% by August 2025, allowing the CBE to initiate an easing cycle—cutting rates by 525 basis points since April 2025 while preserving financial stability. Meanwhile, international reserves climbed to a record $49.25 billion, covering 6.5 months of imports, supported by new long-term inflows and large-scale investments.

The current account deficit narrowed significantly to $13.2 billion in the first nine months of fiscal year 2024/2025, down from $17.1 billion the year before. Remittances surged by 82% to $26.4 billion, while foreign participation in local debt markets strengthened amid easing inflation and positive real interest rates.

Looking ahead, the CBE remains committed to maintaining exchange rate flexibility, deepening FX markets, and pursuing a data-driven monetary policy that balances stability and growth.

Banking Sector Performance and Resilience

Abdalla affirmed that Egypt’s banking sector remains robust and well-capitalized. As of June 2025, the Capital Adequacy Ratio stood at 18.6%, with CET1 at 13.2% and a leverage ratio of 7.6%, all comfortably above regulatory requirements. Non-performing loans were contained at 2.1%, with 90% provisioning, reflecting sound risk management.

Profitability indicators are equally strong, with Return on Equity (ROE) reaching 39% and Return on Assets (ROA) at 2.6%. Liquidity metrics, including the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), remain well above thresholds, underscoring the system’s resilience.

Financial inclusion continues to expand, reaching 75% in 2024, driven by national initiatives targeting women, youth, entrepreneurs, and underserved populations. The rise of digital transformation, from mobile banking and digital wallets to fully digital banks, is further broadening access and reducing transaction costs.

Enhancing Egypt’s Attractiveness to Investors

To attract more investment, Abdalla highlighted that the CBE’s primary mission is to ensure macroeconomic stability and policy clarity. “One of the most valuable things we can offer as a central bank is clarity,” he stated, emphasizing the importance of transparent communication in a volatile global landscape.

The Bank is also working to develop deeper financial markets, diversify debt and equity instruments, and ensure the financial system supports credit flows to the real economy—particularly to the private sector.

Egypt’s strengthened external position, bolstered by strategic partnerships and large-scale investment commitments, is enhancing investor confidence. Ongoing privatization and state-asset sales programs further complement these efforts, creating fresh investment opportunities.

The CBE is also aligning its mandate with emerging strategic themes, including ESG-linked finance, the green transition, and digital finance ecosystems—ensuring that Egypt remains competitive and future-oriented.

Driving Financial Innovation and Digital Transformation

Under Abdalla’s leadership, the CBE has accelerated Egypt’s financial innovation agenda. The Instant Payment Network (IPN), launched via InstaPay, now serves over 12.7 million users, revolutionizing real-time payments and digital access.

Cross-border remittances are also being modernized to enhance speed and reduce costs. In July 2023, the CBE introduced licensing regulations for digital banks, followed by the issuance of the first digital bank license in 2025.

Initiatives such as digital lending via behavioral scoring, alternative data through the Egyptian Credit Bureau (I-Score), and biometric eKYC systems are enabling broader access to financial services. Moreover, the Bank is developing a national AI strategy for the banking sector to optimize operations and supervision.

The innovation ecosystem is further supported by the $150 million Nclude Fund—the largest FinTech fund in the MENA region—and the FinYology initiative, which engages over 30 universities in FinTech research and development.

Internally, the CBE is upgrading its core banking and treasury systems, building a unified data platform for faster supervision, and establishing an AI-ready Tier 4 data center—a major leap in the Bank’s digital transformation journey.

Governor Hassan Abdalla’s vision reflects a comprehensive approach to economic stability, digital innovation, and global investor engagement. Through decisive monetary action, structural reforms, and an unwavering focus on modernization, the Central Bank of Egypt is steering the nation toward a more resilient, transparent, and technologically advanced financial future.